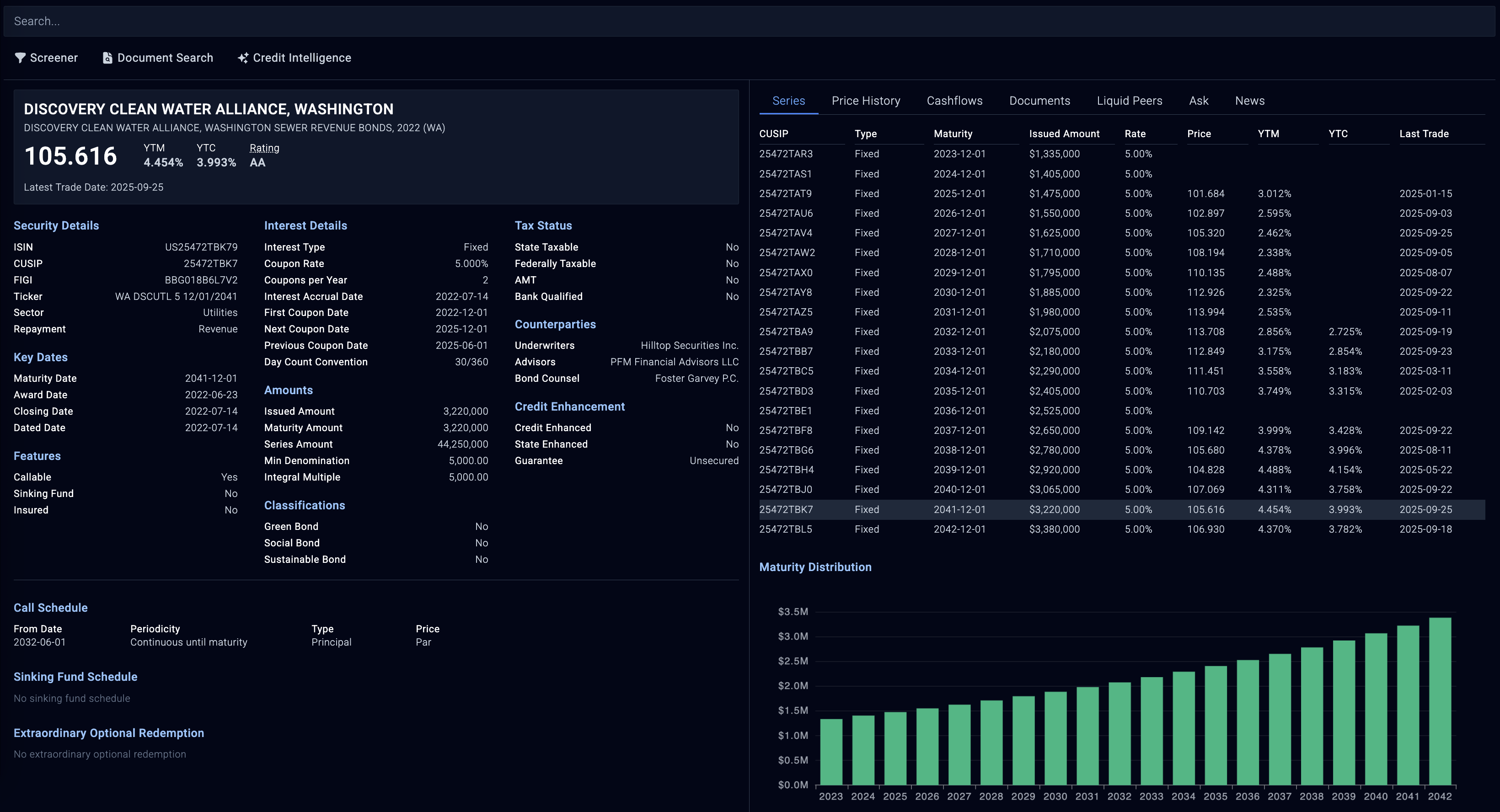

We provide comprehensive fixed income reference data across three main asset classes: US municipal bonds (1.2M+ securities across 50,000+ issuers), government bonds (US Treasuries, Gilts, Bunds, etc.), and corporate bonds (US and European issues).

Each US municipal bond has over 100 data-points including full call, sinking fund and interest payment schedules to accurately model securities at any level - individual, issuer, state, sector, and more.